Written by Joy W

Imagine, a Lamborghini Huracan sports car—worth about $250,000—is displayed in the backdrop of a desolate, untamed desert, in dead silence. Suddenly a violent explosion blows up with numerous shattering fragments scattered in the middle of the desert.

This is the latest project from the conceptual artist Shl0ms’— $CAR. The remains of the destruction of the car created this collection of 999 NFTs, with 888 NFTs open for auction while the rest, 111 of them, were reserved for the team. The car parts are 3D photographed into 4k videos.

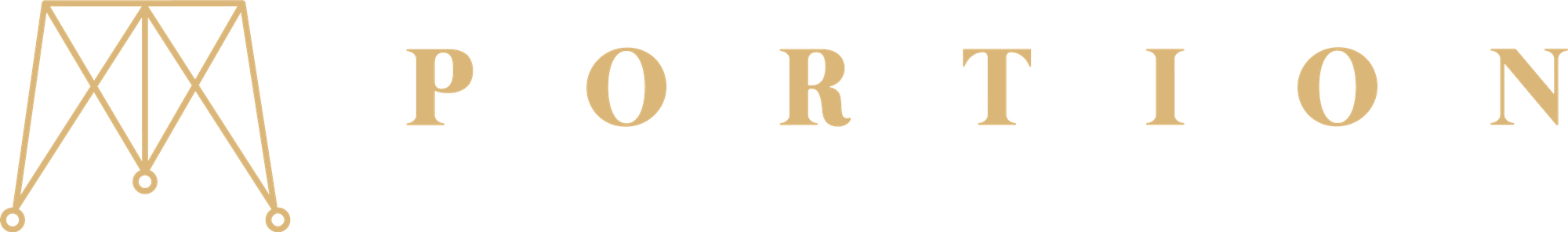

Now, think of the Lamborghini Huracan as one NFT, and imagine the total of 999 fractionalized Lamborghini Huracan remains are owned by 999 people—that’s essentially the idea of NFT fractionalization.

Fractionalized NFTs have been around for over a year now, though in crypto terms, seems like much longer than that. Let’s take a look at the rationale behind fractionalizing NFTs and how to go about creating fractional ownership.

A Brief History on Fractional NFTs

Fractional ownership is popular in conventional finance for high-value assets such as automobiles, vacation houses, and luxury automobiles. This enables an investor to expose his or her portfolio to a high-priced item without having to purchase it altogether. To put it another way, fractionalizing an asset fractionalizes the risks and costs of investing in that single asset. The same rationale is true for fractional NFTs.

One of the early projects to experiment with fractional NFTs was NIFTEX. NIFTEX, acquired by an undisclosed company in October 2021, was a protocol for splitting NFTs. On NIFTEX, NFT fractionalization is done by breaking NFTs into “shards” or “ERC20s” and selling them on its own exchange.

Another early fractionalized NFT collection worth mentioning was the B.20 collection released by Metapurse, back in January 2021. Metapurse is the crypto fund owned by Metakovan and then partner Twobadour; the fund successfully won the bid for Beeple’s Everydays — The First 5,000 Days in March 2021.

B.20 tokenized a collection of twenty 1/1 Beeple NFTs, one music NFT by 3LAU, two parcels in Cryptovoxels, 25 plots of land in Decentraland, one plot from Somnium Space, and three builds created by VoxelArchitects. The collection is represented in “B20” tokens—a fungible ERC20 token that can be traded on DEX to all collectors.

Beeple was initially against the idea of allowing fractional ownership towards his art collection. “My main concern off the top of my head is that people might not like this,” the artist said during a team Zoom call. “My other concern is that other artists will not like this.” The idea of giving access to partial ownership of a piece or a percentage of Beeple artwork to more average investors changed his mind eventually.

Both projects use the idea of “sharding” into ERC20 fungible tokens to add liquidity to ERC721 non-fungible tokens or digital assets. This pioneer thinking and experiment unlocks liquidity for a relatively illiquid crypto asset.

NFT Fractionalization

It’s nice to have an NFT that is unique and belongs only to you, that’s the beauty of many 1/1 NFTs. In this case, why would artists and collectors consider fractionalizing NFTs? There are mainly four reasons for NFT fractionalization: liquidity, accessibility, creating communities (DAOs), and fundraising.

Liquidity

Without fractionalization, NFTs are less liquid compared to fungible ERC20 tokens. To sell an NFT, a buyer should be matched on the order. However, many people get emotionally and culturally attached to their assets and don’t want to give them up. There are ways to create capital efficiency and access liquidity, one being an NFT lending and borrowing product such as NFTFI, as well as fractional NFTs.

Accessibility

The prices of many high-end, high-value NFTs are simply out of reach for most average collectors, such as Autoglyphs, Bored Apes, Cryptopunks, or Fidenza. Instead of having a single owner who has the most capital on the entire NFT, fractionalized ownership allows anyone to have a stake in these high-value collections which they may have been priced out of.

The owner of the original Doge meme NFT PleasrDAO offers fractionalized ownership in the form of $DOG tokens to invite anyone to own a piece of this famous meme after a purchase price of around $4 million in June 2021. PleasrDAO is a collector DAO with many industry members who invest and collect culturally and monetarily valuable NFTs. Others without sufficient wealth will find it difficult to join the group and gain access to the special investment possibilities available only to DAO members. Fractionalized Doge in $Dog tokens opens up the opportunity for investing in this overpriced meme NFT market.

Independent artists also embrace the fractionalization of NFTs for the same reason. Photographer Jay Toups expresses his sentiment on fractionalizing his 1/1 photography NFT, ELYSIAN FIELDS, into 100 editions on Opensea. “I want to be sure to protect my high-end holders, while also giving more people an opportunity to put a photo of mine in their wallet. I want to see my art in the hands of friends and fellow artists and anyone who wants it, WHILE maintaining my floor.”

Communities

Community is the buzzword in the Web3 and NFT space; it makes or breaks a project! It’s also the core value of a DAO. When a large collection is released, it immediately forms a community. For example, Cryptopunk holders share a cultural connection with other fellow punk holders as they belong to the same club/community. Yet for 1/1 NFT holders, you may form connections with other collectors from the same artists, but it’s not as strong of a community compared to the former.

An example for a strong community is SharkDAO, where each member can acquire Nouns NFTs. Members collectively own five Nouns at the moment. This fractional NFT ownership concept invites more Nouns fans to join this community and pool money to purchase Nouns while building a DAO together.

Fundraising

There are quite a few fractionalized fundraising NFT projects surfacing within the NFT market.

UkrainDAO for one, started by Russian-born activist Pussy Riot, is a DAO that raises funds to support humanitarian efforts in the Russia-Ukraine war by fractionalizing a Ukrainian flag NFT. The DAO raised a total of 2258 ETH to donate to Ukrainian civilian organizations.

UNITY is another fractionalized NFT project that raises funds to support people in Ukraine. This 1/1 image created by Jacob Riglin and Aggie Lal is fractionalized into 500 editions through fractional.art with the intent to donate all proceeds to charities.

Where to Purchase Fractionalized NFTs

Three main platforms to fractionalize NFTs are PartyBid, Fractional.art and Fraktal.

PartyBid

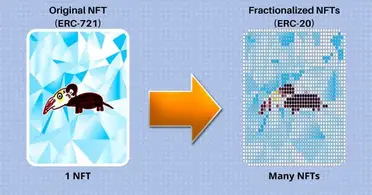

PartyBid, launched in Aug. 2021 by PartyDAO, supports platforms including Foundation, Opensea, Zora, Nouns and Koans. Anyone can use PartyBid to bid on an NFT collectively, having the option to start a new bid (party) or join an existing bid (party). If the party wins a bid, bidders will receive corresponding tokens proportional to the percentage of ownership of the NFT. If the party loses the bid, bidders can claim the unused ETH back.

The platform takes a fee of 2.5% of the ETH used to purchase the NFT, and an additional 2.5% of the resulting fractional tokens. Fees will go to the PartyDAO treasury to self-fund the DAO. In total, PartyBid has 8,011 ETH contributed to 1,239 parties by 17,438 users as of writing.

A memorable piece was Party of the Living Dead on PartyBid where users could bid on a rare zombie Cryptopunk collectively. The party had won the auction at 1173 ETH, which had a total of 1347 ETH in contributions from 478 party members.

Fractional.art

Fractional.art is the backend technology support for PartyBid. Different from PartyBid, Fractional carries the option to list an NFT you own directly from your NFT portfolio and wallet, instead of PartyBid having to import auctions from supported platforms mentioned above.

The Fractional protocol smart contracts are open and permissionless. That means Fractional.art isn’t the only front-end user who can directly interact with the protocol, anyone can build their own Fractional front-end.

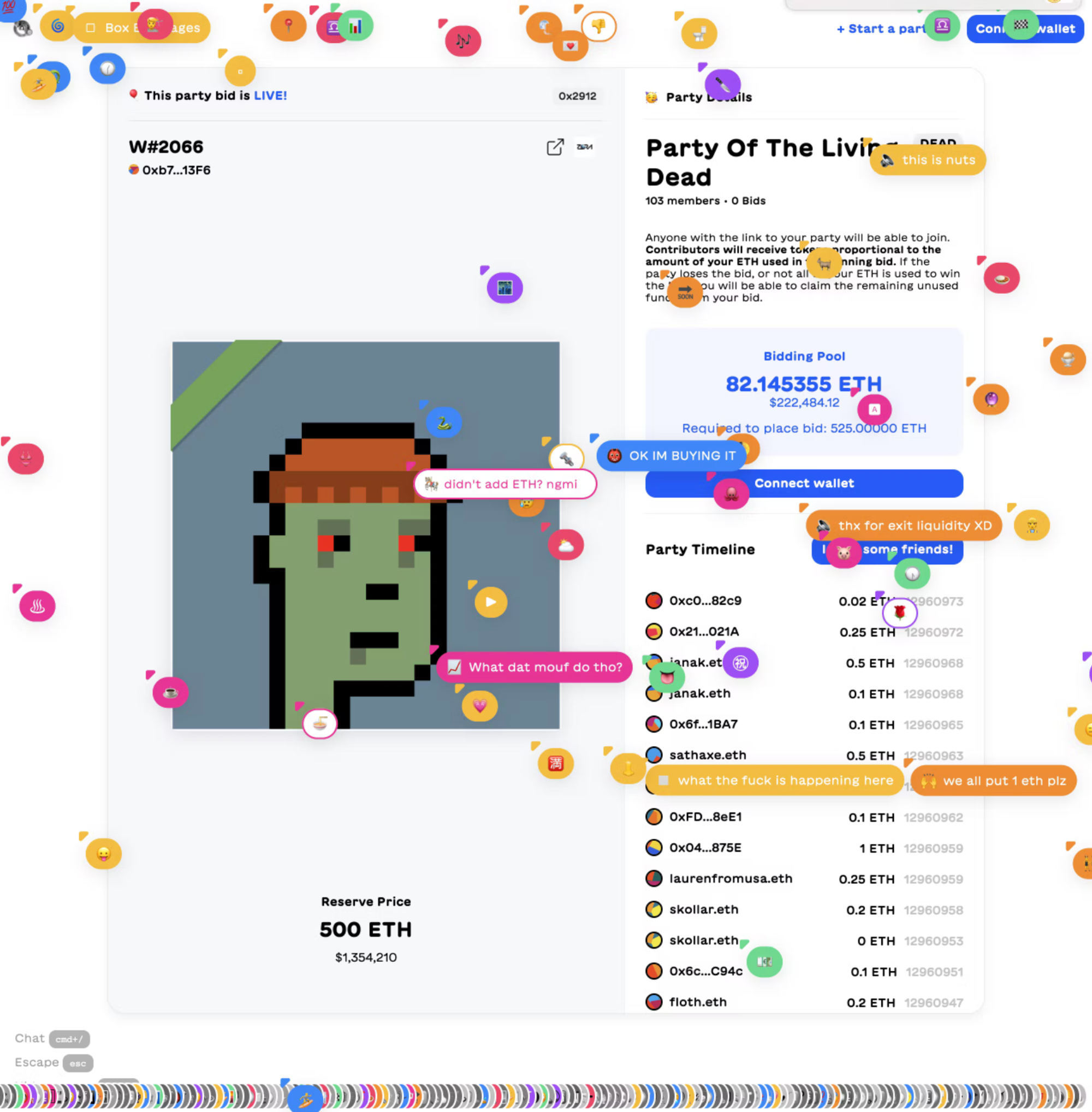

Fraktal NFT marketplace

Fraktal is the new player in the fractionalized NFT game introducing new paradigms in the NFT, DAO, and DeFi intersection. First and foremost, Fraktal is a community-owned protocol and governed by the users via the Fraktal DAO. Users can stake $FRAK to earn fees generated from the platform.

The new NFT marketplace allows users to purchase fractionalized NFTs and directly mint NFTs with a fractionalized option. This fractionalization mechanism invites not only curators (NFT owners) and buyers but also creators to the platform and into the Fraktal ecosystem—Fraktal DAO.

It has the option to sell “Fraktions” at a fix price or through an auction. The revenues feature allows users to manually deposit revenues or royalties received from that particular NFT and to distribute it proportionally among holders.

The Future of NFT Fractionalization

The NFT industry is continuing to grow in popularity and demand, and we can expect to see more fascinating breakthroughs and use cases as blockchain technology advances.

The notion of fractional NFTs is still in its infancy, but it appears to be one of the next big things in the ever-expanding crypto sector. NFT fractionalization offers higher liquidity and, as a result, limitless investing ideas. It opens up the market to a far larger pool of investors, assuring that the next wave of digital asset monetization will be fueled by fractional NFTs.

Join the Portion Community:

Discord | Twitter | Instagram | Blog | Decentraland